With Us Buying a Home Never Felt So Easy

Home purchasing made painless

Buying a home can feel overwhelming. Mutual of Omaha Mortgage can help you make an informed and smart decision on your home.

-

Know your number

-

Shop with Confidence

-

Make Homeownership a reality

-

Learn the products

-

Understand the process

-

Check out best practices and tips

-

Historically low interest rates

-

Streamlined process

-

Easy to use digital mortgage app

See What Our Customers Have to Say

Hee Chul Lee in Sterling Heights, MI

On January 06, 2026Tony is the friendliest person I’ve had the pleasure of working with. Refinancing is not easy—there’s a lot of paperwork and the process itself can feel overwhelming—but Tony made everything incredibly smooth. He stayed in touch at all times and gave us timely heads-ups whenever something was needed to keep things moving forward. Because Tony prepared my wife and me for what to expect and what was coming next, we always had everything ready. The entire process took just a couple of weeks, from our very first phone conversation with Tony to closing on the refinance. It was truly a breeze. I would definitely recommend Tony to anyone looking to refinance. He is absolutely the best of the best. Thank you, Tony!

Rebecca J. Sobolevsky in Idaho Springs, CO

On December 08, 2025Todd was very helpful and communicative and worked overtime to get things done! Thank you !!

235 Insurance

On December 02, 2025Todd's closed a handful of mortgages for me. His expertise is indispensable and I always know where I stand from pre-qual until closing.

Keith Z Murphy in NAPERVILLE, IL

On December 02, 2025Knows what he's doing and explains what he's doing to put you at ease.

Desiree E Garland in Fairfax, VA

On December 01, 2025Luis was very responsive and extremely helpful through out the entire process. His honesty and transparency made my goals a reality. Basically, Mr. Godmere helped make a horrible situation a life changing one for the better! Very greatful!

Doyle G Nelson in Raeford, NC

On November 26, 2025Luis was so pleasant to work with! He was always so polite & professional. I feel that Luis became a friend . I regret our meetings weren't face to face! I doubt that we will ever work together again but would be delighted to do so !!!

Taylor Huffman in Mentor, OH

On September 04, 2025Mike and his team worked effortlessly to get us closed and ready to go while dealing with a difficult situation with our buyer on our current home

Kelsey C Von Wormer in Detroit, MI

On August 22, 2025Tony combines exceptional competence with a genuine passion for lending, qualities that distinguish him within the real estate field. Moreover, he embodies many additional strengths. He is truly pleasant with whom to work, personable, detail-oriented, and possesses a well timed and notable sense of humor. I would select Tony a million times over, and I fully expect to do so again in the future. One would be both prudent and fortunate to entrust him with any loan needs.

Cailin McDermott in BERWYN, IL

On August 12, 2025Daniel jumped into action on a weekend with zero notice to get us preapproved to put an offer in on our dream house. Only later did we find out that he was doing so from the hospital, where his wife had just given birth to their son! While I can't help but feel bad about blowing his phone up during that time, he knew how time-sensitive it was to complete all of this so that we'd have a chance at buying this home, and did everything he could do to get us there. We are forever grateful.

Vinod R Gaglani in Edison, NJ

On August 04, 2025Everything was transparent and mortgage was done in less than 30 days. No hidden cost and any other surprises. Mike is a great peron to work with and made everything easy to understand so there was no stress.

96629 Reviews

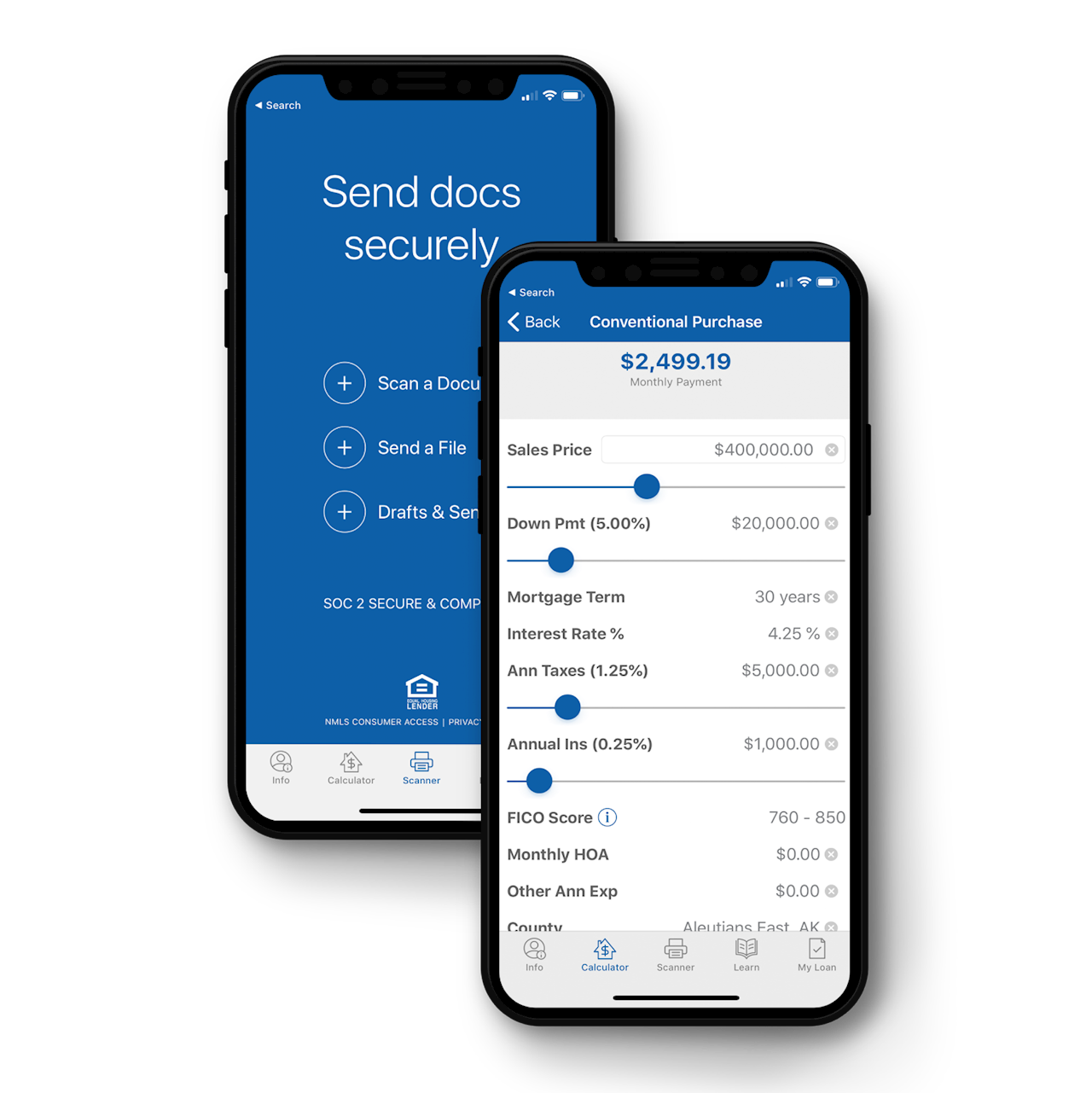

Mortgage Tools at Your Fingertips

With the Mutual of Omaha Mortgage App, you’ll have all your mortgage tools in one place and move the process forward with a tap.

- Apply at anytime, from anywhere

- Quickly access calculator tools to estimate your mortgage payments

- Securely scan and send loan documents with ease

- Check your loan status 24/7

- Direct access to your loan officer

Mutual of Omaha Mortgage is proud to be part of a company with a rich history.

Founded in 1909, Mutual of Omaha serves over 4.6 million individual product customers and 36,000 employer groups.

For a century – through countless historical events – Mutual of Omaha has been there to keep promises to its customers. Inspired by hometown values and a commitment to being responsible and caring for each other, Mutual of Omaha Mortgage continues that legacy. Our mission is to provide home financing solutions that help our customers, and back our services with operational excellence at every level. Today, as the nation grapples with new financial realities, Mutual of Omaha Mortgage is strong, stable, secure, and ready to meet your mortgage and financial needs.

Home purchase tips from the experts.

Get preapproved or start your home loan appication

Mortgage questions. Simple answers.

Mutual of Omaha Mortgage can prequalify you based on your answers to questions about your credit, income and employment. We will suggest a prequalification for the lending product based on our discussion: a suggested loan product, interest rate estimate and down payment requirement before submitting a formal application. Get Started!

Although the 30-year fixed-rate mortgage is most often recognized by prospective buyers, it's not the only option available. The 15-year mortgage product can offer unique benefits and advantages that may help a prospective homebuyer achieve their goals by best matching their financial needs.

The 15-year fixed-rate mortgage is a great option for homebuyers with the right financial profile, who have the ability to make higher payments each month. A 15-year fixed-rate mortgage may allow these homebuyers to pay off their mortgage sooner than a 30-year mortgage and enjoy lower interest rates. Read More

Buying a home is typically the largest purchase a consumer will make in their lifetime. Committing to a mortgage is often a long term agreement. It's important that prospective homebuyers take time to carefully establish how much house they can afford and what percentage of income should go towards their monthly mortgage payment. To determine how much money should be allocated to a monthly mortgage payment, it's imperative for potential homebuyers to have a full understanding of the process, and identify what percentage of income a mortgage payment should be in order to comfortably and confidently afford monthly payments. Read More

The more you can pay up front, the less you'll pay in interest over time. If you are purchasing a home, aim for at least a 20% down payment. Anything less than that will require Private Mortgage Insurance (PMI). If 20% is not possible, put down at least 10%, otherwise you'll get hit with an even higher interest rates and fees. So if you're buying a $300,000 house, you should save up at least $30,000-$60,000 as a down payment. Get Started Today!

The time has come. You’re ready to make the transition from renter to homeowner, but aren’t sure where to start.

With so many types of homes and loan options, crossing the finishing line and closing on your dream home can seem like a daunting task. Take a look at our top 10 tips to make your life as easy as possible during the home buying process. Read More

The more you can pay up front, the less you'll pay in interest over time. If you're purchasing a home, aim for at least a 20% down payment. Anything less than that will require Private Mortgage Insurance (PMI). If 20% is not possible, put down at least 10%, otherwise you'll get hit with an even higher interest rates and fees. So if you're buying a $300,000 house, you should save up at least $30,000-$60,000 as a down payment.